The independent advisor space is evolving fast…and we’re right in the middle of the conversation.

Muriel Consulting is honored to be featured across the industry for the work we do helping advisors take agency, make bold moves, and build modern, enduring RIAs.

The Industry Is Talking. Here’s Where We Show Up.

We’re grateful to the journalists, hosts, and partners who spotlight our work. If you’re looking for expert insight on advisor transitions, RIA launches, or the human side of going independent, we’re always open to meaningful collaboration.

To schedule an interview, contact Business Operations Manager Shelly Hadel.

-

Muriel Consulting’s Shelby Nicholl helps decode Commonwealth advisor exits after LPL deal

In this analysis of Commonwealth’s sale to LPL Financial, Muriel Consulting founder Shelby Nicholl offers expert insight on why roughly 22.5% of advisors left despite retention targets, what trends the data reveal for the industry, and how advisor priorities like boutique culture and technology are shaping post-merger moves.

-

The Power of a Family Meeting: Planning, Legacy, and Love

Brad Connors interviews Shelby Nicholl, who shares the story of her father-in-law's final act of love: a well-planned family meeting that brought clarity, comfort, and connection. This conversation can help you take the step to having conversations like this in your own family.

-

Thinking About Making a Move? The Questions Every Advisor Should Ask First with Shelby Nicholl

Shelby Nicholl sits down with Libby Greiwe in her podcast, The Efficient Advisor, to unpack the increasingly complex landscape of advisor independence. Together, they walk through how to think strategically about change, avoid costly missteps, and design a transition that truly supports your long-term vision.

-

Navigating Consolidation, RIAs, and Advisor Control

Catherine Tindall hosts Shelby Nicholl on the Financial Advisors Want To Know Show podcast where they unpack what’s driving advisor movement right now. They take a practical look at the operational and emotional realities of breaking away—and what it actually takes to do it well.

-

How asset location fuels financial advisors' value to clients

Shelby Nicholl explains how thoughtful asset-location strategies enhance the value advisors deliver to clients by improving tax efficiency and strengthening long-term financial outcomes.

-

$1T in assets, 7,476 advisors: Top IBD moves and M&A deals of 2025

Shelby Nicholl is featured as a respected thought leader, sharing her perspective on advisor transitions and the trends shaping the future of the industry.

-

2026 expert predictions: What's next for wealth management

Shelby Nicholl recognized as an industry expert, shares her forward-looking perspective on key trends shaping the future of wealth management and advisor transitions.

-

LPL Losing Nearly $1B in Commonwealth Assets to Rival B/Ds

Shelby Nicholl, a trusted industry expert, offers clear, strategic insight into advisor behavior during major firm transitions.

-

Kestra, Raymond James Are Early Leaders in Drawing Commonwealth Advisors

The article features Shelby Nicholl as an expert industry commentator, highlighting her role as a go-to advisor on advisor transitions, recruiting trends, and the strategic decisions firms face following major acquisitions.

-

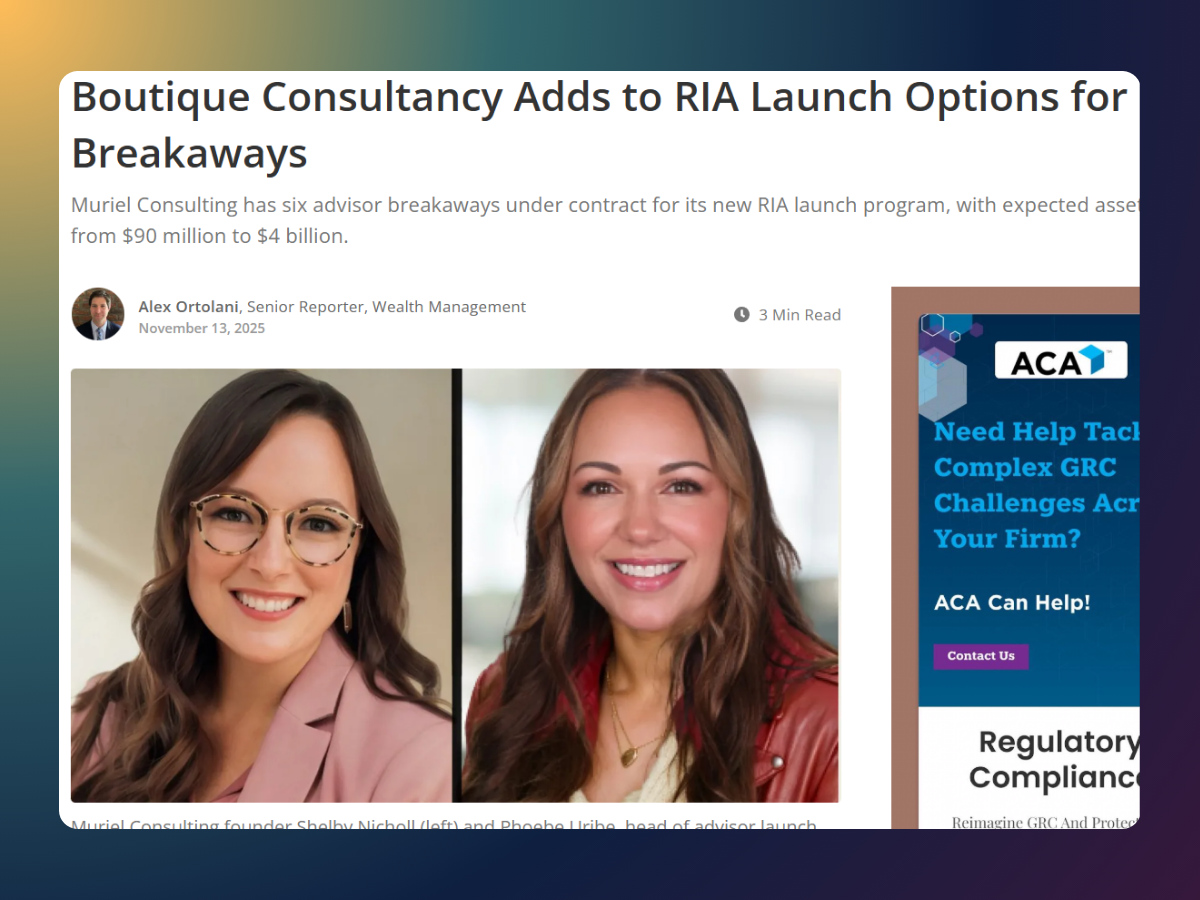

Boutique Consultancy Adds to RIA Launch Options for Breakaways

Wealthmanagement.com covers the news of Muriel Consulting’s RIA Launch Accelerator and hiring of Phoebe Uribe.

-

Edward Jones reports assets are up, but so is advisor attrition

Shelby Nicholl is quoted as an expert on Edward Jones and advisor movement.

-

Edward Jones outlines new two-tier partnership and equity plan

Shelby Nicholl participates in an article about recent changes in equity offerings at Edward Jones. Shelby spent nearly a decade of her 25-year corporate career at Edward Jones.

-

The Future of Financial Advising

Shelby Nicholl is interviewed by Matthew Jarvis for The Perfect RIA. They discuss the recent acquisition of Commonwealth by LPL and its implications for financial advisors. The discussion also touches on the worth of making a move and when it might be better to stay put.

-

Should I stay or should I go?

Shelby Nicholl joined Steven Jarvis for a conversation about how advisors can think about the firm structure they find themselves in and the key factors to consider when confronted with the question "should I stay or should I go".

-

Reinventing Your Practice

Kristin Harad hosts Shelby Nicholl on the Full Advisor Coaching podcast where they explore how advisors can recognize when it’s time to evolve and how to take smart, confident steps toward a more fulfilling practice.

-

Looking at Networking From the Inside Out: A Professionals Look at Culture From Within Large Organizations

Mike Garrison interviews Shelby Nicholl, a seasoned corporate veteran turned entrepreneur and certified exit planning advisor. The conversation delves into the evolution of networking skills, the contrasting cultures of Edward Jones and LPL Financial, and the importance of building a strong referral network.

-

How Should an RIA pick a custodian?

Shelby Nicholl is featured in the 8th installment of a series on how to build a successful RIA, published in Financial Planning and written by Chief Correspondent Tobias Salinger.

-

Should financial advisors be dually registered or RIA only?

This is the seventh installment in a Financial Planning series by Chief Correspondent Tobias Salinger on how to build a successful RIA.

-

New List Item

Dinah Wisenberg Brin publishes a Q&A with Shelby Nicholl. Nicholl discussed red flags advisors should watch out for — both at their current firm and in the moving process — and why she expects another wave of breakaway advisors.

-

Why We're Enhancing Our Focus on Recruiting Momentum

ThinkAdvisor announces why they are enhancing focus on recruiting and advisor transitions.

-

Mastering Negotiation for Female Advisors

The Tech It Up podcast features Shelby Nicholl to share strategies to navigate negotiations, overcome self-doubt, and secure career opportunities with confidence.